Clayton:

In summer 2014, my 1-year visa to Ireland expired, and I was told very nicely to leave the country. While I hadn’t planned to wind down my poker career, I found myself back in Ames (Iowa), where online poker is still banned today.

I was couch surfing with friends and decided to learn more about technology startups, because I had met a handful of angel investors who told me that building a tech company was faster paced than playing 40 tables of online poker at once.

I was intrigued but had no business ideas of my own. I started asking around Iowa State University campus about professors who had started and scaled companies before. Everyone I asked pointed me to Econ 334, the “best class on campus for starting a company.”

2 weeks later, I’d find myself walking into Econ 334, meeting professors Dave Krog and Kevin Kimle. Serial entrepreneurs.

I was about to find out that I was exactly where I was meant to be.

On day 1 of Econ 334, Kevin and Dave passed out a book that had just been published around the time I was leaving Ireland. That book was All In Startup. As a copy was placed in front of me, I thought to myself, “huh, a poker term.”

I quickly realized it was about an entrepreneur who was making a run at the World Series of Poker in Las Vegas. 2 months from that moment, I’d co-found my first company, KinoSol.

Flash forward to February 2022 (8 years later!), I’d find myself back in Econ 334 (where they still read All In Startup), to share my story from playing poker and building both KinoSol and Nebullam.

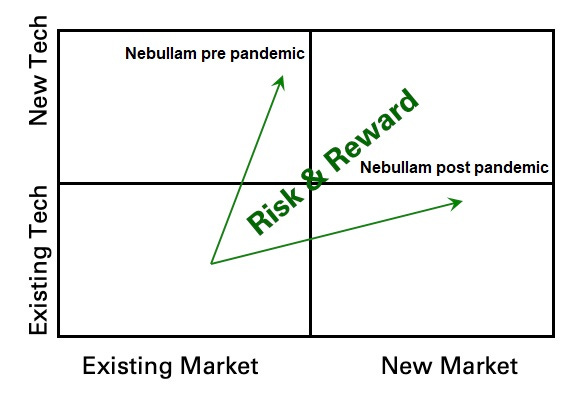

Kevin started that class by drawing a chart with 4 quadrants, highlighting Risk & Reward. I thought it was a great visual for charting out new ideas and asked Kevin to provide his insight on it, right here.

Kevin:

This chart can be used as a simple means to classify new business ideas. Where does it fit on a continuum of a business entering an 1) existing versus new market, and using an 2) existing versus new technology? As you move further out on each axis, the risk becomes greater. A new market may develop, or it may not. A new technology may have superiority to existing alternatives and be attractive to customers, or it may not. The way you view a new business and its inherent risks depend on where it falls on this chart.

How an aspiring entrepreneur evaluates business model, potential partners, financing types; all these things depend at least partly where their business fits on this chart. Another pizza restaurant in Campus Town in Ames probably fits into the lower left quadrant. It may have great pizza that enables it to compete effectively in the market, but its impact on the larger market is likely limited.

As risk increases, so do potential rewards. The Google guys weren’t the very first founders to create an Internet search engine, but they created the best new technology and business model in a new market, and they were rewarded handsomely.

Clayton:

As I watched Kevin walk through the chart, I thought about which quadrant Nebullam fell into. It wasn’t as easy as I thought, because Nebullam isn’t in the quadrant it once was.

When Danen and I started Nebullam, we wanted our technology to grow as much food per square foot as possible, while requiring as little labor per square foot as possible. So, we focused on designing and building the hardware and software to do just that.

We fell into the New Tech, Existing Market quadrant (top left).

When the pandemic hit, we were in the middle of proving out our new tech, with all our revenue coming from wholesaling our produce to (mostly) restaurants. We lost most of our revenue overnight, which forced us to move from an Existing Market to a New Market.

That New Market is a hybrid between e grocery, meal kits, and on-demand food delivery. The pandemic didn’t create this market, but it did accelerate it by a handful of years. At Nebullam, we fall into this New Market, because we offer a direct-to-consumer subscription service for our produce.

We own the supply chain, from the moment a seed is started in our nursery, to the moment we deliver the fresh food on someone’s doorstep. Because we entered a new market, we had to build our own fulfillment tech stack as well.

We shifted from the top left quadrant to the top right quadrant.

The shift in quadrants brought us 10x more excitement.

I think it’s because we’ve now landed in the great unknown, with the highest risk and highest reward. And it helps that it’s currently working. Not only for revenue, but we’re finding more talented people shifting to this quadrant. More venture dollars flowing to this quadrant. More opportunity to build—or in our case, grow—what people want.

The quadrant you choose to start in should excite you. And if a world changing event comes along and threatens to take all progress away, you must be open to jumping into another quadrant—a pivot.

Here are a few additional industries and companies within them that come to mind for the top right quadrant.

Keep building.